Interview with Andrea Danielli, Founder & CEO of Mopso.

From curiosity to practice

After almost ten years working as an analyst and inspector at the Bank of Italy, where I dealt with anti-money laundering and customer protection. I enjoyed exploring my curiosity and wanted to put my ideas for a secure financial future into practice, which led me to start Mopso, the startup that developed Amlet.

In addition to my experience at the Bank of Italy, I also worked at the Italian Ministry of Education, collaborating on the development of educational policies, conducting research, analysing data, and writing articles.

Additionally, in my free time, I like to read essays and write articles on innovation. My educational background led me to obtain a degree in philosophy of science and a master’s degree in epistemology.

The project

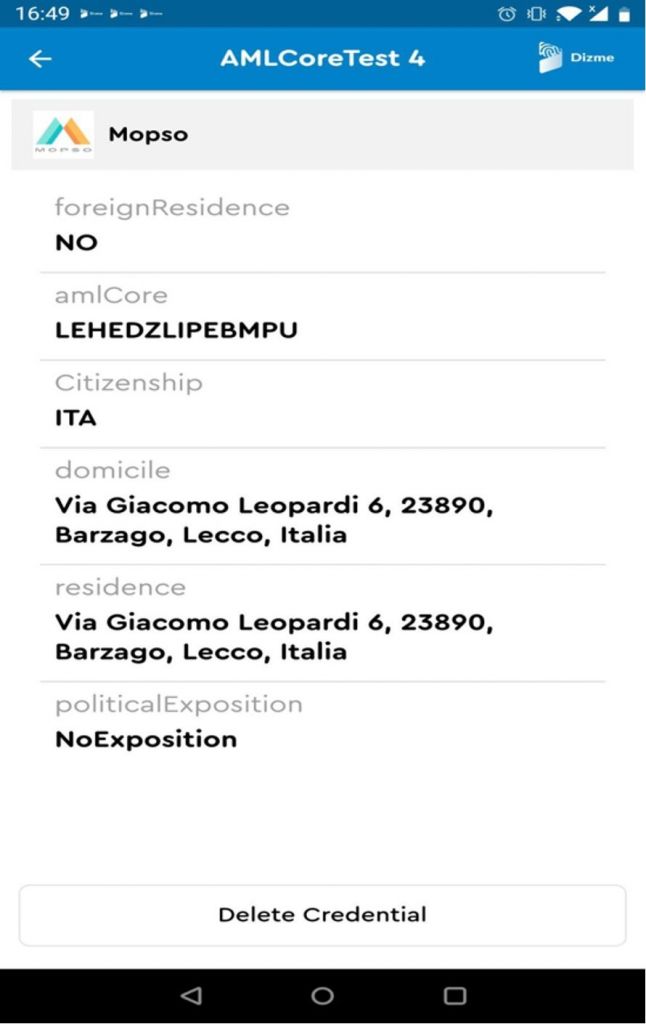

Amlet streamlines Customer Due Diligence (CDD) for financial institutions by automating the process. This replaces the manual, repetitive, and time-consuming process with a machine-assisted one. Amlet uses AI to forecast customer risk and makes due diligence data “portable” and reusable within an ecosystem of intermediaries, simplifying onboarding procedures and reducing the risk of money laundering.

Amlet will rely on the forthcoming European Digital Identity wallet: we will issue anti-money laundering verifiable credentials, synthesising all the needed information. We strongly believe that Self-Sovereign Identity is the future of digital identities: an open and decentralised system based on cryptography, a revolution that will impact several industries at the same time.

How did you come up with the idea for your project?

The project was a result of collaborative teamwork. We were introduced to Self-Sovereign Identity (SSI) while we were trying to find a solution for the Covid 19 pandemic: we figured out the Covid passport well before it came to life. At the same time, while working on anti-money laundering issues, we were wondering how to share customers’ data without the need for a centralised database, a nightmare from the point of view of GDPR and cybersecurity. With some serendipity, we eventually met SSI.

Amlet could allow access to banking and financial services during confinement, working purely online and remotely.

The financial and mentoring support from NGI

Thanks to the financial help of eSSIF-Lab, the NGI project we attended, we were able to carry out various tests of our dynamic questionnaire and we tried the integration with some wallets already available. The possibility of joining a community of experts who develop technologies similar and close to ours has allowed us to stay up to date with the standards under development and to understand the world of Self-Sovereign Identity better.

Could you explain briefly what is new and original in your project?

We believe that the portability of adequately verified data, the connection to the European wallet, and the single-click feature represent a winning combination to ensure both the simplification and security of online services. The data portability gives users control over their personal data during their transfer from one service provider to another. This balance between simplification and security represents an important step towards a safer and simpler digital future for everyone.

What problem does your project solve?

Amlet addresses the challenges faced by Financial Institutions (FI) and Real Estate companies in meeting Anti-Money Laundering (AML) regulations while providing customer services. The current Customer Due Diligence (CDD) process involves filling out many forms and presenting personal credentials, causing high costs, waste of time, and friction with customers. Amlet streamlines this process in four ways: 1) client data is machine-readable and easy to transfer, store and verify, 2) much of the data is already validated by third parties, reducing the need for additional verification by the FI, 3) Amlet simplifies any future updates, and 4) provides end-to-end tracking of verifications for regulatory authorities.

Towards the end of the project, what was the evolution of the idea?

Currently, we are conducting a pilot test of Amlet with Illimity and Banca Reale, which allows us to tailor our product by engaging with the needs of our customers. This provides us with valuable insights concerning customer journeys and helps us to continuously improve our offering to meet the changing needs of the market.

Will you take the idea further now that the support from NGI is over?

Yes, absolutely! We are thrilled to continue pushing the boundaries of our Amlet project even after the support from NGI has ended. Our team is fully committed to delivering innovative solutions that meet the needs of our customers, and we see tremendous potential for the future of this project. We plan to grow our project in the future by further developing an ecosystem of many different financial institutions where our technology simplifies the lives of their customers.